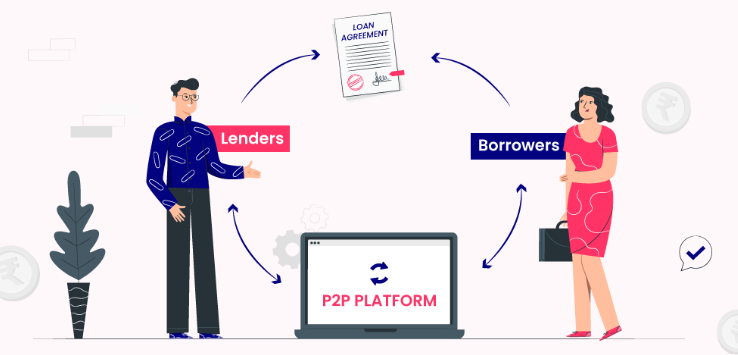

Decentralized Finance (DeFi) has emerged as a disruptive force in the traditional financial landscape, offering innovative solutions for borrowing, lending, trading, and asset management without intermediaries. Powered by blockchain technology, DeFi platforms facilitate peer-to-peer transactions, enabling users to access financial services in a trustless and transparent manner. From decentralized exchanges (DEXs) to lending protocols, DeFi platforms represent a paradigm shift in the way we perceive and interact with finance. In this comprehensive guide, we delve into the world of DeFi platforms, exploring their functionalities, benefits, and potential risks to help you navigate the decentralized finance ecosystem with confidence.

Understanding DeFi Platforms

DeFi platforms are decentralized applications (DApps) built on blockchain networks, such as Ethereum, Binance Smart Chain, and Solana, that enable users to engage in various financial activities without relying on traditional financial intermediaries. By leveraging smart contracts, DeFi platforms automate the execution of financial transactions, eliminating the need for centralized authorities and reducing counterparty risk. From decentralized exchanges facilitating peer-to-peer trading to lending protocols enabling users to borrow and lend assets, DeFi platforms offer a wide range of financial services accessible to anyone with an internet connection and a cryptocurrency wallet.

Key Features of DeFi Platforms

1. Decentralization

At the core of DeFi platforms is the principle of decentralization, which removes single points of failure and censorship resistance. By operating on blockchain networks, DeFi platforms ensure that no central authority has control over user funds or transaction processing, fostering trust and autonomy within the ecosystem.

2. Interoperability

DeFi platforms often support interoperability, allowing users to seamlessly interact with multiple protocols and assets across different blockchain networks. This interoperability enables composability, where various DeFi applications can be combined and integrated to create novel financial products and services, enhancing flexibility and innovation within the ecosystem.

3. Transparency

Transparency is a fundamental aspect of DeFi platforms, as all transactions and smart contract code are recorded on the blockchain and accessible to anyone. This transparency fosters trust and accountability, enabling users to verify the integrity of transactions and ensure compliance with protocol rules and regulations.

Popular DeFi Platforms

1. Uniswap

Uniswap is a leading decentralized exchange (DEX) that enables users to swap ERC-20 tokens directly from their cryptocurrency wallets. Powered by automated market-making (AMM) algorithms and liquidity pools, Uniswap provides efficient and permissionless trading with low fees and no KYC requirements.

2. Aave

Aave is a decentralized lending protocol that allows users to borrow and lend various cryptocurrencies without intermediaries. By leveraging collateralized loans and flash loans, Aave offers flexible borrowing options with competitive interest rates, empowering users to access liquidity and earn interest on their idle assets.

3. Compound

Compound is a decentralized money market protocol that enables users to earn interest on their cryptocurrency holdings and borrow assets against collateral. With algorithmic interest rates and instant liquidity, Compound provides a seamless borrowing and lending experience with no minimum or maximum limits, catering to both individual and institutional users.

Risks and Considerations

While DeFi platforms offer exciting opportunities for financial innovation, they are not without risks. Smart contract vulnerabilities, impermanent loss, and regulatory uncertainty are among the challenges facing DeFi users. It’s essential to conduct thorough research, perform due diligence, and understand the risks associated with each DeFi platform before participating in any financial activity.

Conclusion

In conclusion, DeFi platforms represent a groundbreaking evolution in the world of finance, democratizing access to financial services and reimagining the traditional banking infrastructure. By leveraging blockchain technology and principles of decentralization, transparency, and interoperability, DeFi platforms empower individuals worldwide to take control of their financial destiny and participate in a global, permissionless economy. As the DeFi ecosystem continues to evolve and mature, it’s crucial for users to stay informed, exercise caution, and embrace the transformative potential of decentralized finance.