Peer-to-peer (P2P) lending has emerged as a disruptive force in the financial industry, transforming the way individuals and businesses access capital and invest their money. Also known as marketplace lending, P2P lending platforms connect borrowers directly with investors, bypassing traditional financial intermediaries such as banks and credit unions. This innovative approach to lending offers numerous benefits, including competitive interest rates, streamlined application processes, and access to credit for borrowers who may not qualify for traditional bank loans. In this comprehensive guide, we explore the world of peer-to-peer lending, uncovering its features, benefits, and considerations to help borrowers and investors navigate the dynamic landscape of alternative lending with confidence.

Understanding Peer-to-Peer Lending

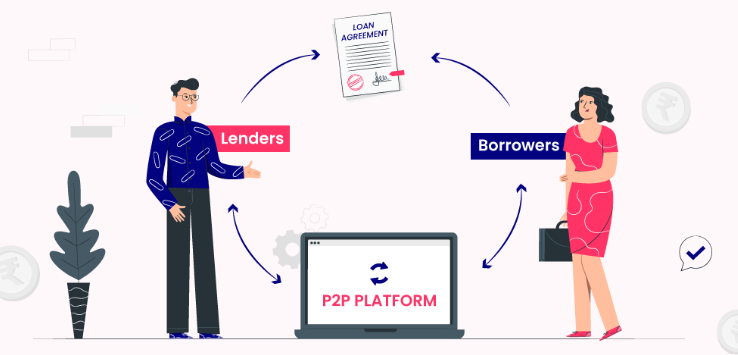

Peer-to-peer lending is a form of debt financing that enables individuals and businesses to borrow money from investors through online platforms. These platforms act as intermediaries, facilitating loan transactions between borrowers seeking funding for various purposes, such as debt consolidation, home improvement, small business financing, and personal expenses, and investors looking to earn a return on their capital by funding loans. P2P lending platforms leverage technology to match borrowers with investors based on factors such as creditworthiness, loan amount, interest rate, and loan term, providing a transparent and efficient alternative to traditional lending channels.

Key Features of Peer-to-Peer Lending

1. Direct Borrower-Investor Connection

One of the primary features of peer-to-peer lending is the direct connection between borrowers and investors. P2P lending platforms enable borrowers to create loan listings detailing their financing needs, credit profile, and loan terms, which are then made available to investors for review and investment. Investors can evaluate loan listings based on risk and return characteristics and choose to fund individual loans or diversify their investment across multiple loans to minimize risk and enhance returns.

2. Competitive Interest Rates

Peer-to-peer lending offers competitive interest rates for both borrowers and investors. Borrowers may access lower interest rates compared to traditional bank loans, particularly for borrowers with strong credit profiles, while investors have the opportunity to earn attractive returns by funding loans with higher interest rates than traditional fixed-income investments, such as savings accounts, certificates of deposit (CDs), or government bonds.

3. Streamlined Application and Approval Process

P2P lending platforms streamline the loan application and approval process, offering borrowers a convenient and efficient alternative to traditional bank lending. Borrowers can complete loan applications online, provide documentation electronically, and receive loan offers and funding decisions within a matter of days, eliminating the lengthy approval process associated with traditional bank loans and enabling borrowers to access capital quickly when needed.

Benefits of Peer-to-Peer Lending

1. Access to Credit

Peer-to-peer lending expands access to credit for individuals and businesses that may not qualify for traditional bank loans due to limited credit history, thin credit files, or unconventional financing needs. P2P lending platforms use alternative credit scoring models and risk assessment techniques to evaluate borrower creditworthiness, allowing borrowers with diverse financial backgrounds to access funding for a wide range of purposes.

2. Diversification and Portfolio Building

For investors, peer-to-peer lending offers opportunities for portfolio diversification and income generation. By investing in a diverse portfolio of loans across different borrower profiles, loan grades, and loan terms, investors can spread risk and minimize exposure to any single loan default or economic downturn. Additionally, P2P lending provides investors with regular interest payments and potential capital appreciation, enhancing overall portfolio returns and stability.

3. Flexibility and Control

Peer-to-peer lending provides borrowers and investors with flexibility and control over the lending and investment process. Borrowers can customize loan terms, including loan amount, interest rate, and repayment term, to meet their specific financing needs and preferences, while investors can select individual loans or automate investment strategies based on risk tolerance, investment objectives, and desired returns, giving them control over their investment decisions and portfolio composition.

Considerations for Borrowers and Investors

While peer-to-peer lending offers numerous benefits, borrowers and investors should consider several factors before participating in P2P lending. These include:

- Credit Risk: Assess the credit risk associated with peer-to-peer lending, including the risk of borrower default, late payments, and loan losses, to evaluate the potential impact on investment returns and borrower financial health.

- Platform Reputation: Research the reputation and track record of P2P lending platforms, including user reviews, ratings, and regulatory compliance, to ensure that the platform is reputable, trustworthy, and compliant with applicable laws and regulations.

- Loan Terms and Conditions: Review the terms and conditions of individual loans, including interest rates, loan amounts, repayment terms, and fees, to understand the financial implications and obligations associated with borrowing or investing through P2P lending platforms.

Conclusion

In conclusion, peer-to-peer lending has revolutionized the borrowing and lending landscape, offering borrowers access to credit and investors opportunities for portfolio diversification and income generation. By leveraging technology, data analytics, and alternative credit scoring models, P2P lending platforms provide a transparent, efficient, and accessible alternative to traditional bank lending, empowering individuals and businesses to achieve their financial goals. Whether you’re a borrower seeking financing for personal or business needs or an investor looking to earn attractive returns while supporting the real economy, peer-to-peer lending offers a compelling opportunity to participate in the evolving landscape of alternative lending and investing.