Cryptocurrency, once viewed with skepticism, has now emerged as a formidable asset class, captivating both seasoned investors and novices alike. In recent years, cryptocurrency investments have gained significant traction, offering unparalleled opportunities for financial growth and diversification. At the heart of this burgeoning market lies a complex ecosystem of digital currencies, blockchain technology, and decentralized finance (DeFi) platforms reshaping the future of finance. In this comprehensive guide, we delve into the world of cryptocurrency investments, exploring the dynamics, strategies, and potential pitfalls to help you navigate this exciting landscape with confidence.

Understanding Cryptocurrency Investments

Cryptocurrency, a digital or virtual form of currency secured by cryptography, operates on decentralized networks, such as blockchain, eliminating the need for intermediaries like banks. Bitcoin, the pioneer cryptocurrency, paved the way for thousands of alternative coins (altcoins), each with unique features and use cases. From Ethereum to Ripple, Litecoin to Cardano, the crypto market boasts a diverse array of investment options catering to various risk appetites and investment goals.

The Appeal of Cryptocurrency Investments

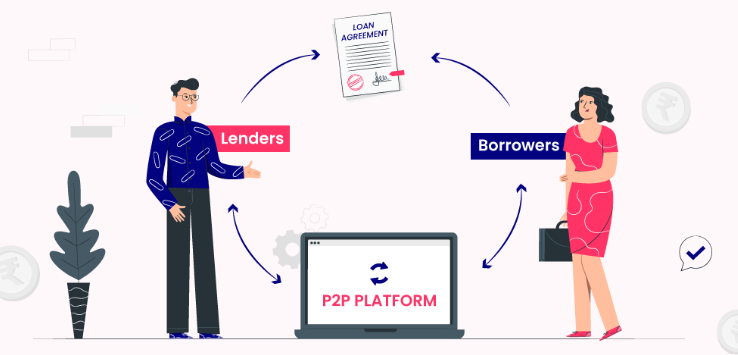

What makes cryptocurrency investments so enticing? Unlike traditional assets, cryptocurrencies offer unparalleled accessibility, enabling users to transact seamlessly across borders with minimal fees and delays. Moreover, the potential for exponential returns has attracted a new wave of investors seeking to capitalize on market volatility and technological innovation. With the rise of decentralized finance (DeFi) protocols, users can participate in lending, staking, and yield farming, earning passive income and maximizing their investment potential.

Developing a Winning Investment Strategy

While the allure of quick profits may be tempting, successful cryptocurrency investing requires a disciplined approach and strategic foresight. Before diving into the market, it’s essential to conduct thorough research, understanding the fundamentals of each asset, market trends, and regulatory developments. Diversification across multiple cryptocurrencies can help mitigate risk and optimize returns, ensuring a well-rounded investment portfolio.

Mitigating Risks in Cryptocurrency Investments

Despite its potential rewards, cryptocurrency investments are not without risks. Market volatility, regulatory uncertainty, and cybersecurity threats pose significant challenges to investors, necessitating robust risk management strategies. Implementing prudent risk management measures, such as setting stop-loss orders, diversifying across assets, and securing assets in reputable wallets, can help safeguard your investments against unforeseen adversities.

Navigating Regulatory Landscape

As cryptocurrencies continue to gain mainstream acceptance, regulatory oversight has become increasingly stringent. From anti-money laundering (AML) to know your customer (KYC) regulations, compliance with regulatory requirements is paramount to ensure the legitimacy and longevity of your investments. Staying abreast of evolving regulatory frameworks and engaging with reputable platforms compliant with industry standards can mitigate legal risks and foster trust in the ecosystem.

Harnessing the Power of Blockchain Technology

Beyond its role as a speculative asset, cryptocurrency embodies the transformative potential of blockchain technology. From decentralized finance (DeFi) to non-fungible tokens (NFTs), blockchain applications extend far beyond currency, revolutionizing industries like finance, healthcare, and supply chain management. By understanding the underlying technology and its real-world applications, investors can identify promising projects with long-term viability and disruptive potential.

Conclusion

In conclusion, cryptocurrency investments represent a paradigm shift in the world of finance, offering unprecedented opportunities for wealth creation and technological innovation. By understanding the dynamics, risks, and regulatory considerations inherent in the cryptocurrency market, investors can navigate this evolving landscape with confidence and foresight. Whether you’re a seasoned trader or a novice enthusiast, embracing a strategic and disciplined approach to cryptocurrency investing can unlock new horizons and shape a prosperous financial future.